URVA for Banking

Smarter Leads, Stronger Compliance, Faster Collections

Trusted by

the best

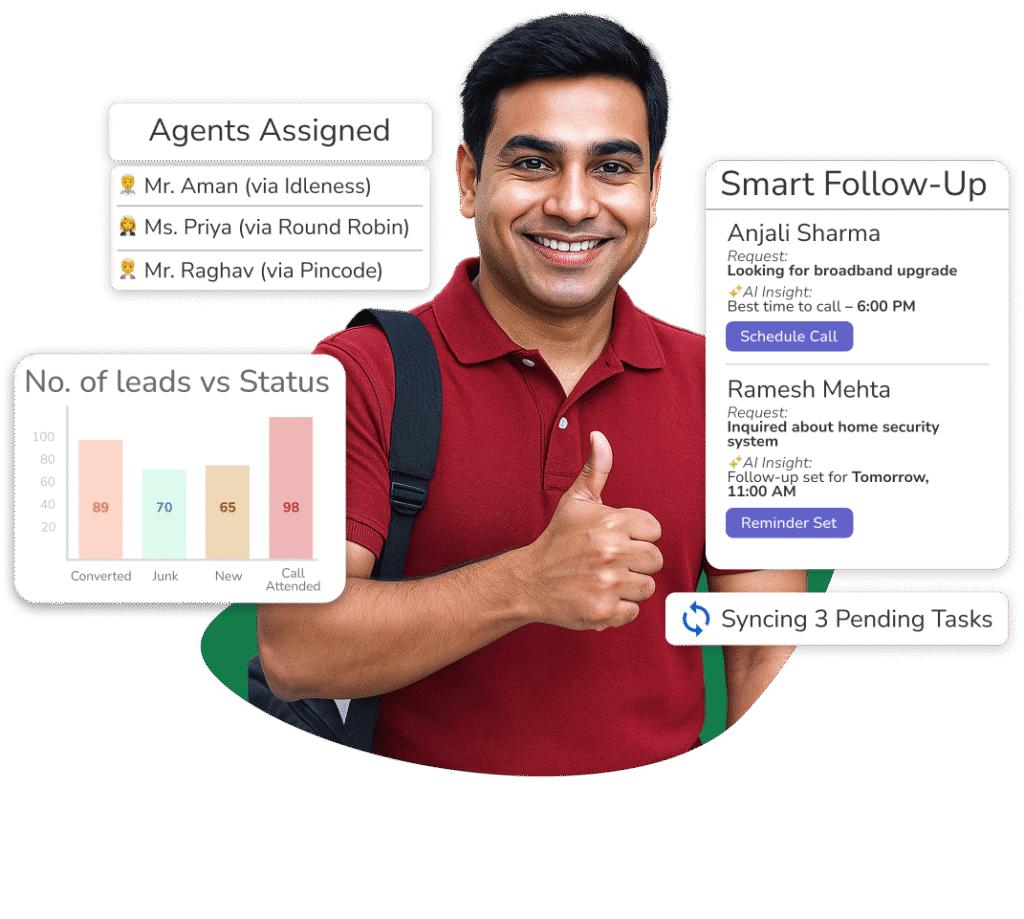

Are Housing Loan Leads Rotting in Excel Sheets?

Smarter Lead Handling, Stronger Customer Bonds URVA centralizes every lead touchpoint-from walk-ins to WhatsApp-to boost response times and conversions.

⚡ Smart Allocation – Auto-assign by product, branch, or source.

🔔 Instant Alerts – Notify RMs and staff as leads arrive.

📋 Unified Capture – Log walk-ins, calls, and online forms in one place.

⏰ Follow-Up Nudges – Automate reminders for callbacks, KYC, or docs.

📈 Live Tracking – Monitor fresh, warm, hot, or closed leads.

👨💼 Manager Insights – View lead health and conversions by branch or zone.

Lead Management

❝ URVA has transformed how we capture, assign, and monitor leads. It has brought visibility and speed to our frontline sales operations, helping us serve customers faster and better.❞

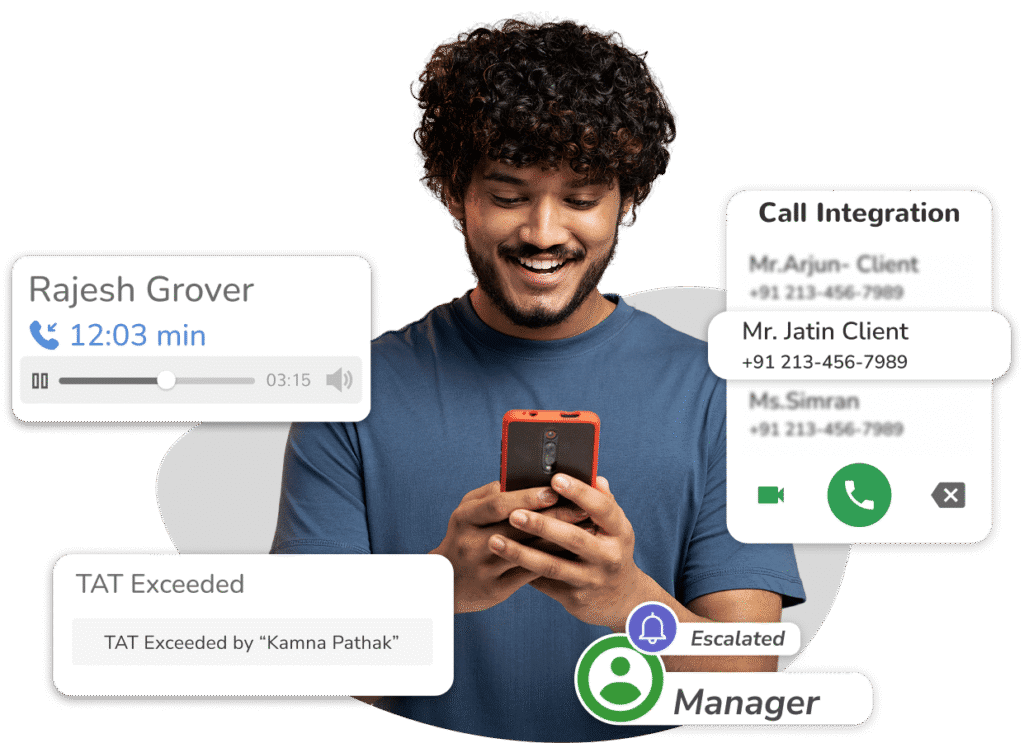

Struggling to Track Customer Conversations?

Log, Centralize & Audit Every Banking Interaction

Communication Tracking

❝ With URVA, we now have a centralized, traceable communication system for our Relationship Managers. The WhatsApp integration has brought convenience and transparency to every customer interaction.❞

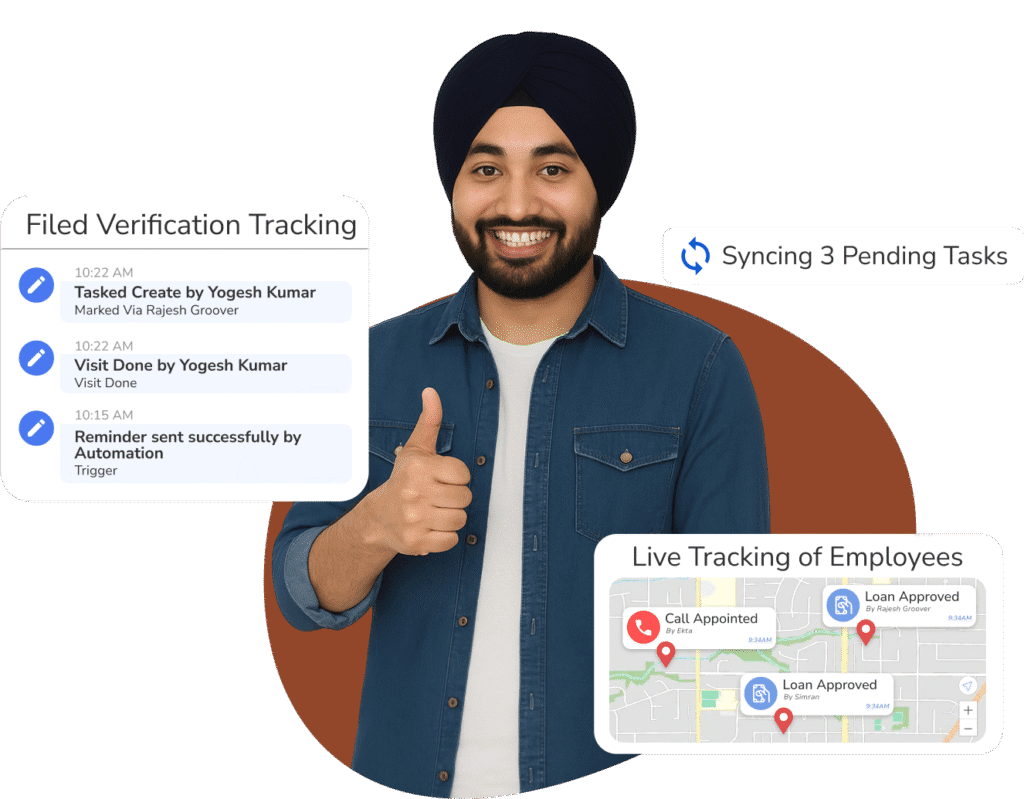

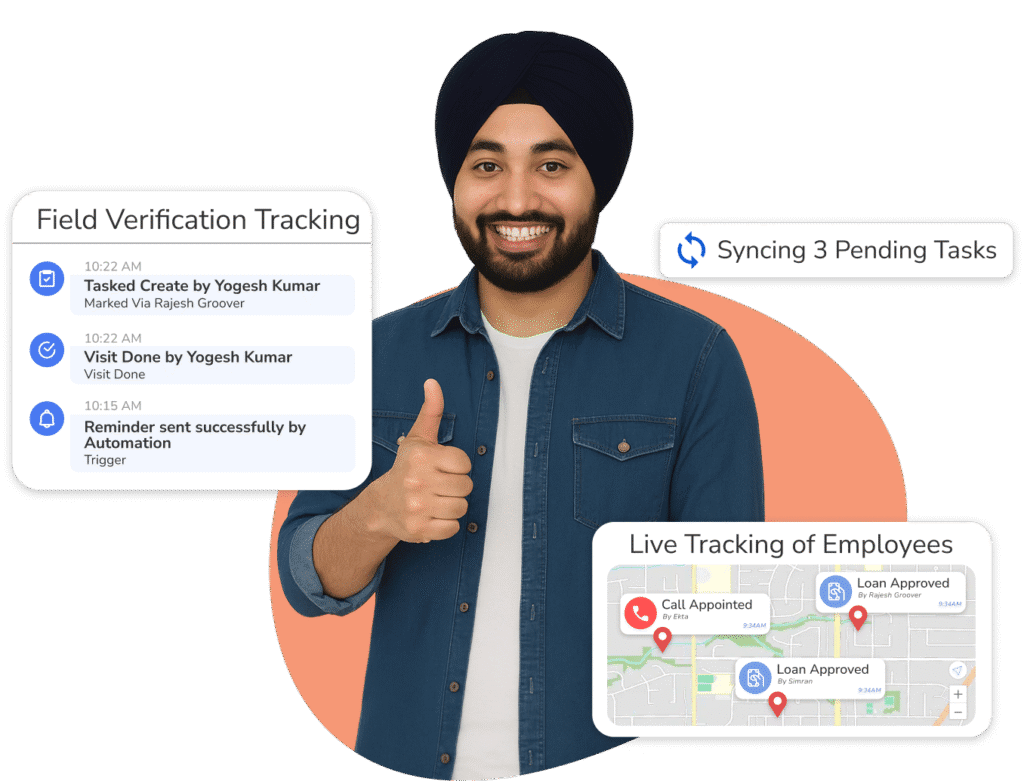

Slow, Error-Prone Verifications Costing You Customers?

Fast, Field-Ready & Tamper-Proof Banking Verification

Verification

❝ URVA has given us a single-view platform to manage all our customer verification processes. The turnaround time for field verifications has significantly reduced, with better audit controls❞

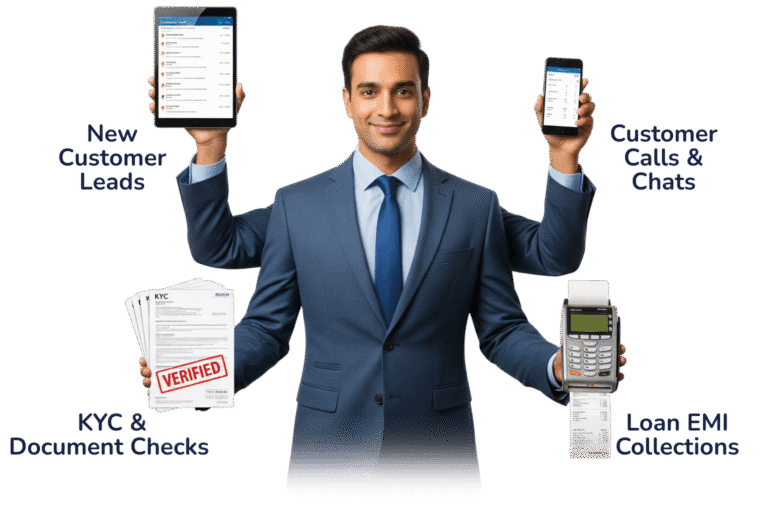

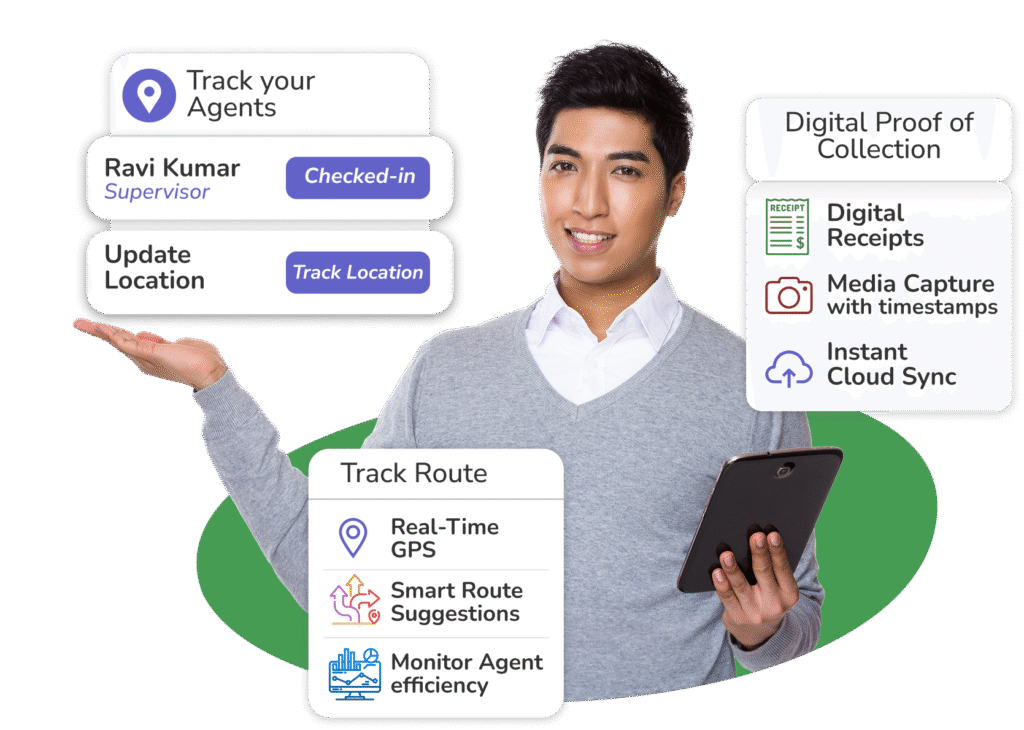

Losing EMIs and Collection Visibility?

Faster, Smarter & Fully Compliant Banking Collections

📱 Mobile-First Agent Toolkit – Empower field agents with real-time collection tools.

🗓️ Auto-Scheduled Visits – Assign collection tasks by due date, zone, and priority.

🔄 Instant Sync with HO – Keep head office updated without endless “status” chasers.

🖊️ Proof of Collection Capture – Record photos, notes, and e-signatures instantly.

✅ Compliance at Every Step – Ensure secure, traceable recovery touchpoints.

📊 Live Recovery Dashboard – Track payments, follow-ups, and success rates in one view.

Collections

❝ URVA’s digital-first field collection module has enabled us to streamline agency performance, improve recovery rates, and ensure compliance across every touchpoint.❞

Struggling with Incomplete or Delayed Audits?

Seamless, Transparent & Compliant Banking Audits

📅 Automated Audit Scheduling – Assign audits based on branch, priority, and compliance cycles.

📸 Digital Evidence Collection – Capture photos, documents, and e-signatures on-site.

⏱️ Real-Time Audit Tracking – Monitor status, findings, and escalations without manual follow-ups.

🗂️ Centralized Compliance Records – Maintain audit trails with timestamps and attachments.

🚨 Instant Issue Escalation – Flag irregularities and trigger corrective actions instantly.

📊 Comprehensive Audit Dashboard – Gain branch-to-HO visibility on all audit activities.

Audit Management